2017 to teach you how to buy the most cost-effective new auto insurance must see the four auto insurance strategy

2017 teach you how to buy Car insurance The most cost-effective novice must see four auto insurance strategy

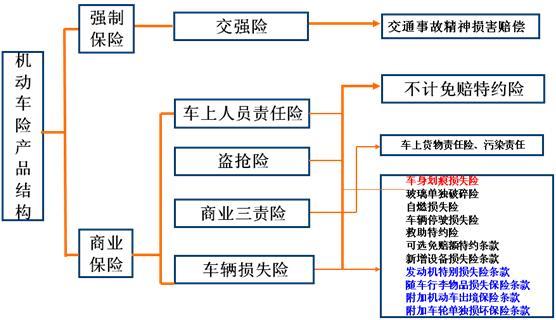

Start with a new car, Insurance Have to keep up, but the car Insurance type There are many kinds, expensive, exactly what kind of insurance must buy, what kind of insurance don't have to buy�� Today we will give you a few common types of insurance��

�� will be on the risk Compulsory insurance

The full name of " motor vehicle traffic accident liability compulsory insurance", is China's compulsory insurance�� Is all vehicles must be on, it is clear that when the traffic accident occurs, pay compulsory insurance compensation is to compensate the injured party, and the amount of compensation is limited�� Total liability limit for compulsory insurance is 12. $ 20,000�� This is not enough in the face of some major accidents, so may need to three risks, etc. to cooperate��

�� will be on the risk of three risks

The full name is a third party commercial liability insurance�� Is also an accident, the third party's economic compensation, for more than the compulsory insurance compensation limit, by Insurance company Responsible for compensation, so the owners of friends as far as possible at the same time to cover compulsory insurance and three risks, so that in the event of a major traffic accident, the insurance company can help you pay the excess cost�� The three risks are also used to compensate for the loss of people and goods made by the other party��

U will be on the risk of car damage insurance

The first two kinds of insurance are used to pay the other party, and the car damage insurance is used to pay the insured person's own�� Including collisions, scratches, water-flooded fires, bruises, losses caused by natural disasters, etc�� Here also want to pay attention to two points: separate parts damage is not compensate, also don't try so hard in this case, naturally add work, separate into multiple parts damage, don't love dearly, the insurance company will help you repair; Modification, loss of vehicle interior and engine damage caused by flooding are not compensable�� So if you are very expensive to modify a buy a new equipment insurance, valuables had better not put in the car, compensate the engine has a special Water - related risk��

�� will be on the risk Non - compensable risk

Non - compensable means transferring 20 % of the original owner's liability to the insurance company�� Regardless of the exemption is divided into basic insurance and additional insurance, the former for the car damage insurance, the three basic insurance independent effective; The latter applies uniformly to the additional risks of motor vehicles�� Is when you miss driving crashed into a tree caused 1000 yuan of damage, because it is a unilateral accident, the insurance company normally compensate you only 80 % of the loss, that is, 800 yuan, but if you buy the non-compensable insurance, you can get 1000 yuan 100 % compensation��

�� don't have to on the self-combustion insurance

Self - combustion insurance is a kind of auto insurance to provide compensation for the situation of vehicle spontaneous combustion, this kind of auto insurance is limited to vehicle warranty payment, in fact, the warranty period of vehicle spontaneous combustion is responsible for by the manufacturer, so the new car is not recommended to buy�� If the warranty period has expired, you can purchase according to the actual situation��

�� don't have to go on water-related risks

Water - related insurance is mainly for engine damage caused by flooding compensation, if you are less flood area, so this kind of insurance is not necessary to buy��

U don't have to on the glass broken risk alone

Glass broken risk alone is not much need to buy, the insurance in fact as long as you learn to flexible processing, so you can turn into a car damage insurance��

�� don't go up Scratch risk

This can actually buy don't buy, look at the models, if the purchase model price is not expensive, paint cost is not very expensive, can not buy, the cost of their own maintenance is close to a risk again next year Buy insurance When the cost of rising, so it is not very cost - effective��

�� summary

If it is a daily use, the above four kinds of insurance is basically enough�� But in any case, it is important to observe traffic regulations and maintain a good driving habit�� Safe travel, happy is our pursuit of car life��

Four auto insurance strategies for beginners

In addition to the license plate, the next most important thing is to buy auto insurance�� For inexperienced novices, where should I buy auto insurance�� Which car insurance is necessary�� What kind of car insurance is suitable for what kind of car owners�� These are the big questions��

Based on the general needs of the people, sir painstakingly compiled this " novice must see four auto insurance strategy", aimed at helping you clear your mind, rational choice of a car insurance in line with their own situation��

Automobile insurance Where to buy?��

Now buy auto insurance mainly provides four ways:

First, when buying a car or in the future in 4 s shop

Second, app purchase

Third, go to the big insurance company business hall to buy

Fourth, buy it on the official website of the major insurance companies

Fifth, telephone purchase

Sir respectively on the four ways to buy the analysis and comparison:

Shop 4 s The price will be more expensive than the other way, because the 4 s shop has to earn a certain fee�� But according to sir, now 4 s shop in order to woo customers, there will be to buy auto insurance to send maintenance activities�� For send maintenance this matter, are benevolent wise men see wisdom, but sir calculate a bill: suppose 4 s shop launched to buy auto insurance to send a year of maintenance activities, a household car driving 10000 kilometers a year, need to do two maintenance, a maintenance cost is about 600 yuan, a year can save 1200 yuan, so it is also cost - effective�� ( for maintenance choose to do in 4 s shop owner, in fact is completely acceptable )

Mobile app Nowadays, many car-related apps can already realize the function of purchasing auto insurance ( for the users at the b - end and c - end ). this kind of app collects the auto insurance business of each major insurance company, and users can easily search for regions, compare prices, compare schemes and compare preferences, so as to select the most suitable auto insurance for themselves��

The other three ways I put him into one category - insurance company

Insurance company The price is cheaper than 4 s shop, but without after-sales service, the car insurance may not go to 4 s shop maintenance��

Sir's advice is whether the individual owner or choose 4 s shop more secure, maintenance and service can be guaranteed�� Maintenance store insurance agency business can choose mobile app, comprehensive information, transparent price��

What are the types of auto insurance��

Although there are many types of car insurance, sir summed up: one kind of car insurance is necessary to buy, another kind of car insurance is available or not to buy��

Compulsory insurance must be purchased , and the car damage insurance, third party insurance, excluding free compensation, Pirate rescue , company insurance, and so on��

1, what is compulsory insurance?

Compulsory traffic insurance is stipulated by the law of our country every car owners must be forced to buy insurance�� It effectively ensures that vehicles have the most basic insurance claims in case of traffic accidents�� Especially for some in addition to the car, the poor car owners in the home�� In the event of a traffic accident, compulsory insurance can replace his hard-to-pay financial compensation�� If not in accordance with the provisions of the purchase of compulsory insurance, the traffic administrative department of the public security organ shall have the right to detain the motor vehicle, and impose a fine of 2 times the premium payable��

2, why do you want to buy compulsory insurance?

A compulsory traffic insurance sign will be issued to the owner after the purchase of the compulsory traffic insurance, and the sign will also need to be affixed to the front windshield of the vehicle�� If not according to the requirements of paste, the traffic police can be deducted 1 points to the owner, a fine of 200 yuan��

How much does it cost to buy compulsory insurance?

Compulsory insurance premiums are based on the number of seats in the country to implement a unified price, six new car 9.50 yuan a year, six more than 1100 yuan��

If there is no accident insurance during the insurance period, the next year renewal according to the benchmark premium down 10 %, the minimum can be down 30 %�� However, if there are more accidents, the premium will rise in the coming year, up to 30 %, even by the insurance company refused to protect treatment��

4, pay strong insurance have what circumstance does not compensate?

Jiaoqiang does not compensate for all accidents, such as intentional accidents, drunk driving, and vehicle damage insurance during the theft of vehicles are not compensable��

5, what is the scope of compensation for compulsory insurance?

The amount of compensation for compulsory insurance is affected by whether there is a responsibility, whether to cause casualties�� For general vehicle injuries, the maximum compensation is $ 2,000 if the vehicle is liable and $ 100 if the vehicle is not liable��

If cause casualties, have the responsibility of medical expenses under the circumstances of the maximum compensation of 10 thousand yuan, the maximum compensation of 110 thousand yuan death�� No liability for medical expenses under the circumstances of the maximum compensation of 1000 yuan, 11000 yuan compensation for death��

6, what is the car damage insurance?

Car damage insurance refers to the insured or its permitted driver in driving an insurance vehicle insurance accident, resulting in damage to the insurance vehicle, the insurance company to compensate within a reasonable range��

How much does it cost to buy a car?

The premium cost of car damage insurance has a great relationship with the purchase price of the car and the number of seats�� There is a formula can be calculated, car damage insurance premium = basic premium + naked car price * rate�� While the average household 5 car damage insurance premium is 593 yuan, the rate is 1. 5%��

For example, a 5 - seater new car, car purchase price ( including travel tax ) is 128000 yuan, then its car damage costs are: 593 + 128000 * 1. 5 % = 2513 yuan��

Ps: except for compulsory insurance, the cost of other insurance is the original price�� But in the actual purchase process, there will be a certain discount, and different periods, different insurance companies discount rate is different��

8, car damage insurance under what circumstances don't compensate?

Car damage is only compensated for damage to the vehicle body, but some small parts of the individual damage is not covered by the compensation, such as rearview mirrors, lights, glass ( excluding skylight glass ), paint, wheels ( including tires and hubs ), etc��

For new cars that have not been licensed, or have not received a temporary license, the loss caused by the accident is not within the scope of compensation for the loss of the car�� In addition, if after the accident, can't find the accident insurance company can only compensate for 70 % of the loss��

Also need to pay attention to is, car damage insurance in compensation, will be based on the use of the vehicle after a certain depreciation compensation�� The depreciation rate for cars is 0. 5 % per month. 6%��

9 And, What is third party insurance?

Third party liability insurance Refers to the accident, in addition to the driver of the car and passengers caused by other people's personal injury or property damage directly, by the insurance company in accordance with the provisions of compensation�� For example, the insurance company is responsible for driving accidentally into an electric vehicle, damage to the electric vehicle, and compensation for the loss of life and death of the driver of the electric vehicle��

How much does it cost to buy third party insurance?

The cost of third party insurance depends on the level of coverage you choose�� Generally 5, 10, 15, 20, 30, 50, 1 million seven grades is the mainstream, of course, can also choose to insure more than 1 million, but the highest can not exceed 50 million�� Different levels of premium are charged differently��

Take the ordinary family car below 6 as an example, choose 50,000 grade, the premium is 710 yuan a year�� If you choose a level of 1 million yuan to 2234 yuan a year, now most people choose 500,000 or 100 two grades��

11, third party insurance under what circumstances do not compensate?

In the accident caused by the driver or passengers of the car casualties, driving killed, injured their own people, driving damaged their own vehicles, these are the three insurance does not compensate for the situation��

12, what is the scope of compensation for third party insurance?

Different responsibilities in the accident, the amount of compensation is also different�� Only when the other party full responsibility, can get full compensation�� If you are fully responsible, the insurance company can have 20 % of the exemption, the main responsibility is 15 % of the exemption, the same responsibility is 10 % of the exemption, secondary responsibility is 5 %��

13, what is the whole car stolen rescue?

Name is a good understanding, is for the whole car was stolen, robbery caused by vehicle losses to provide compensation services insurance services�� If the vehicle was stolen, robbed by the public security criminal investigation department at or above the county level for investigation confirmed full 60 - 90 days and no whereabouts, by the insurance company direct compensation��

14, buy stolen rescue how much money?

There is a formula for the insurance premium of the whole vehicle theft rescue: the insurance premium of the whole vehicle theft rescue = ( vehicle price - depreciation ) * premium rate + fixed premium�� Depreciation is 6 ��, a month only for second-hand car or old car renewal effective, new car don't have to ignore�� Premium rate and fixed premium are different according to different models and uses, and ordinary household 5 car theft emergency basic premium is 120 yuan, the rate is 0. 49 %��

To make it easier to understand, give two examples�� Example 1: a 128000 yuan of ordinary home five new cars, the whole car stolen rescue premium = 128000 * 0. 49 % + 120 = 747. 2 yuan�� Example 2: a 128000 yuan ordinary home five car, has been in use for 2 years�� Then the renewal of the whole car stolen rescue premium = ( 128000 - 128000 * 6 �� * 24 months ) * 0. 49 % + 120 = 656. 9 yuan��

15, theft and rescue have what circumstance does not compensate?

If not the whole car was stolen, only the car parts such as tire wheel hub, lights, rearview mirror, etc�� In addition, if the vehicle is modified, unless there is a separate purchase of new equipment for the modified part of the risk, otherwise in the case of theft of the whole car according to the original car compensation��

16, the scope of compensation for illegal rescue

After the occurrence of theft accident, the need to provide motor vehicle registration certificate, motor vehicle driving license, purchase invoices, vehicle purchase tax payment certificate to prove the origin and legality of the vehicle�� Missing anything, increase 0. 5 % absolute free odds�� If the whole car is stolen, the original car keys lost an additional 5 % absolute free odds��

17, what is not exempt from compensation insurance?

The full name of the non-compensable risk is the special term of the non-compensable risk, which is a kind of additional risk�� In many accident compensation, insurance companies can have 5 % - 20 % car free odds�� You can avoid these odds and get full compensation when the owner buys a non-compensable car��

18. how much does it cost to buy a non - compensable insurance?

Excluding the cost of non-compensable insurance is quite cheap, its premium = ( car damage + three risks ) 20 %�� If a 128,000 yuan five-seater car, bought 500,000 three risks, then its non-compensable premium is: ( 1920 + 1721 ) * 20 % = 728 yuan�� This is the calculation method of the whole purchase, regardless of the exemption, in addition, regardless of the exemption can also be purchased separately for commercial insurance, seems everyone likes to buy separately now��

19, regardless of the non-compensable insurance under what circumstances do not compensate?

Purchase of non-compensable compensation is not under any circumstances, it also has four kinds of non-compensable cases: the accident did not leave a certificate to the traffic police can not be held accountable, car parked roadside scratches or third party escape, only to buy the basic risk of non-compensable insurance when the car was stolen robbed, frequent occurrence of additional deduction from the odds��

Sir want to say is that the daily more useful insurance is just a few, you just need to roughly understand what they can provide security, the corresponding cost is how much you can easily determine which should buy which shouldn't buy, don't silly to buy a full car insurance, may be really unnecessary��

What should novice auto insurance buy��

Sir found that in fact the most common car insurance scheme mainly has three kinds:

1. minimum plan: compulsory insurance + third party insurance ( 500,000 )

The cost of compulsory insurance is 950 yuan a year, a third party insurance ( 500000 ) is 1472 yuan, a total of 2422 yuan�� The scheme is the most economical, in addition to pay strong insurance, pay third party insurance, is very suitable for car price is not high or slightly less well-off car owners�� In fact, there is a minimum plan, is to buy only compulsory insurance, other all don't buy�� But few people will buy insurance like this, can be ignored for the time being��

2. basic plan: compulsory traffic insurance + third party insurance ( 500,000 ) + car damage insurance

The cost of compulsory insurance for one year is 950 yuan, the third party insurance ( 500000 ) is 1472 yuan, car damage insurance 2459 yuan, a total of 4881 yuan�� The plan increases the risk of car damage relative to the first, making it a good choice for new drivers who have just obtained a driver's license, as well as for wealthier car owners��

3. general plan: compulsory traffic insurance + third party insurance ( 1 million ) + vehicle damage insurance + non - compensation + vehicle theft and rescue

This scheme is generally 4 s shop to help the owner to buy the so-called full insurance, compulsory insurance cost is 950 yuan a year, a third party insurance ( 1 million ) is 1917 yuan, car damage insurance 2459 yuan, excluding free compensation ( three + car damage + robbery ) is 739. Four yuan, a total of 6065. 4 yuan�� This is mainly for new cars or slightly more expensive car owners, affordable car owners choose this insurance is also a good choice��

Ps: the above calculation method is calculated according to 150,000 new cars��

The above auto insurance purchase scheme is the most car owners will choose the scheme, sir suggested that you put these three schemes as a reference to the amount of auto insurance investment, combined with their own economic level to choose a combination of options��

What should we pay attention to when buying a car��

Beginners often can not buy auto insurance access, nature also easy to fall into the pit�� Sir summed up a few easy to recruit, hope to help you��

1, 4 s shop to buy auto insurance pit

Sir think 4 s shop is the pit of the sales staff fool, buy what risk, don't buy what risk, must choose according to their own economic level�� Before purchase, you can get to know the insurance cost of each major insurance company online, use the brochure to write down, and turn out the brochure before sales settled contrast, if the gap is too big to use other ways to buy insurance��

2. purchase Telephone auto insurance Want to compare three goods

Salesman telephone direct car insurance risk is relatively large, and has a certain amount of deception, must ask clear before buying, conditional recording, in addition, because I don't know the personal information of the specific salesman, chase responsibility is more difficult, serious may also encounter fraud�� After the order, according to the insurance policy number to the insurance company website query is true, we also want to determine the identity of the good send policy personnel, and then to the premium��

3, ask more, choose claims time is short

When buying auto insurance, but also consider the speed of claims, because some insurance companies claim longer, for now time precious office workers, really can't afford to wait�� Sir's advice is to have acquaintances ask acquaintances, no acquaintances on the internet for help net friend, some real insurance company is certainly won't tell you��

4, " three taboos": not full insurance, excess insurance and repeated insurance

Sir can understand those in order to save money, in order to get more compensation after the accident of the car owners, but sir had to popularize the legal knowledge to you:

Article 56 of the insurance law of our country stipulates: " the sum of the indemnity insurance premium of each insurer of duplicate insurance shall not exceed the insurance value�� Unless otherwise agreed in the contract, the insurer in accordance with its Insurance amount And the proportion of the sum of the insured amount shall bear the liability for compensation�� " the

In short, even if the applicant repeatedly insured, also won't get super value compensation��

China's " insurance law" article 39 also clearly stipulates: " the amount of insurance shall not exceed the value of insurance, more than the value of insurance, more than part of the invalid�� If the insurance amount is lower than the insurance value, unless otherwise agreed in the contract, the insurer shall bear the liability for compensation in accordance with the proportion of the insurance amount and the insurance value�� " the

Therefore, over - and under-insurance will not yield additional benefits��

Auto insurance is useless when there is no accident, but when you need it really feel the value of the goods�� After reading this strategy, sir hope everyone in the purchase of auto insurance when considering these:

1, choose the right for their own purchase channels

When buying auto insurance, not only consider the price is cheap, driving habits, vehicle types, buy auto insurance at different stages of the need to consider the problem, understand their own situation, and then choose suitable for their own purchase channels��

2, According to the specific circumstances of the combination of insurance

Sir mentioned in front of the three common combination of insurance, is just a reference, more combination is actually according to their own situation�� For example: driving skilled male car owners buy auto insurance will be partial economy, driving unfamiliar female car owners will be partial complete and security; Owners who don't have a garage will choose to buy stolen rescue��

3, The insurance amount should match the risk requirement

High coverage is unnecessary, too low can't get full risk protection, if you risk level is low, then buy a little more, otherwise you can buy a little less��

The following are questions from netizens:

Net friend a: how to buy auto insurance is the most cost - effective��

Expert a Principle 1: give priority to the purchase of full third party liability insurance�� The ability to compensate others for their losses should be the first priority in the purchase of car insurance, otherwise the accident will only be helpless��

Although the third party liability insurance and compulsory insurance function almost overlap, are used to compensate each other's medical or compensation costs after the owner's car crashed into a person�� However, from the current point of view, the compulsory insurance guarantee ability is limited, it is difficult to cope with major personal injury accident, generally should buy a third party liability insurance��

Principle 2: the insured amount of the three risks shall be subject to the compensation standard of the locality�� The standards of compensation in various parts of the country is different, according to the highest standard of automobile insurance compensation calculation, if one person died, Shenzhen area maximum compensation can reach 1.5 million yuan, Hubei area maximum may also be more than 600 thousand yuan�� It is recommended that the owner look at his old insurance policy, if the amount of insurance is insufficient, it is recommended that at least 200,000 above, conditional insurance of 500,000��

Principle 3: buy the car personnel insurance, then buy the car damage insurance�� If there is no other accident insurance and Medical insurance The owner, to buy their own 100 thousand driver insurance as a medical cost, responsible for the family; If the passenger is more likely to ride, can cover passenger insurance, 50 - 100 thousand / seat, responsible for the family and passengers�� If the chance of riding is low, it is more economical to insure 10,000 seats per seat��

Principle 4: buy car damage insurance and then buy other insurance, traffic accidents are often accompanied by car damage, repair costs should not be underestimated, the protection of car love is also very important��

the vehicle damage insurance Is the most widely used in vehicle insurance insurance, whether it is a daily casual small scratches, or suffered accidents caused serious damage to the car, as long as it is within the scope of insurance liability, can apply to the insurance company for compensation for repair costs�� However, the vehicle loss insurance also has a variety of exemption clauses, so the owner should carefully study the terms of the vehicle loss insurance before insurance, grasp the content of the vehicle loss insurance, so as not to fall into the error of claims��

Principle 5: buy three risks, driver passenger seat liability insurance, car damage insurance of non - indemnity�� For a little more money, let the insurance company compensation without discount��

The so-called non-compensable insurance, its full name is " non - compensable special liability insurance"�� Excluding special liability insurance is divided into two kinds of basic insurance without exemption and additional insurance without exemption�� The main risks corresponding to the basic insurance excluding the non-compensation are the vehicle loss insurance and the third party liability insurance�� Additional risks excluding the corresponding is such as " scratch risk", " illegal rescue" and other additional insurance��

Principle 6: other types of insurance shall be purchased selectively in combination with their own needs�� Such as illegal rescue, glass broken risk insurance, such as relative to the first five risks, the impact on family happiness and property is not as serious as the first five risks, should be in front of the five principles to meet the case to consider the insurance in principle 6��

Net friend b: how to buy auto insurance does not spend money, novice must see

Expert b: the level of premium is closely related to the number of occurrences and amount of claims made in the previous year�� According to the regulation, as long as the owner within one year without any violation records, insurance and claims, the owner in the second year to pay the premium will be commercial insurance, compulsory insurance premium cut, at the same time will also be listed by the insurance company as a high quality customers enjoy preferential auto insurance�� The second year of auto insurance should be in the way of purchase, insurance choice to make a reasonable choice, not only to achieve full insurance, but also can't waste money�� Choose the most suitable insurance portfolio, in order to make the future driving life is the real interests of the owners, I hope the above content is helpful to you��

2017 teach you how to buy Car insurance The most cost-effective novice must see four auto insurance strategy

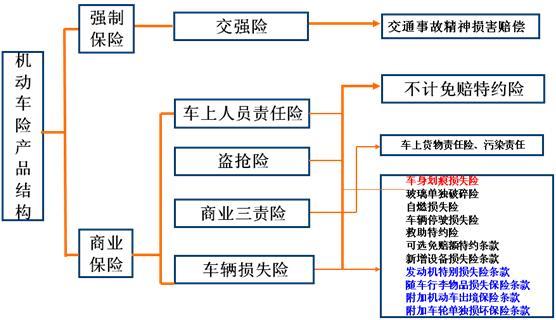

Start with a new car, Insurance Have to keep up, but the car Insurance type There are many kinds, expensive, exactly what kind of insurance must buy, what kind of insurance don't have to buy? Today we will give you a few common types of insurance。

★ will be on the risk Compulsory insurance

The full name of " motor vehicle traffic accident liability compulsory insurance", is China's compulsory insurance。 Is all vehicles must be on, it is clear that when the traffic accident occurs, pay compulsory insurance compensation is to compensate the injured party, and the amount of compensation is limited。 Total liability limit for compulsory insurance is 12. $ 20,000。 This is not enough in the face of some major accidents, so may need to three risks, etc. to cooperate。

★ will be on the risk of three risks

The full name is a third party commercial liability insurance。 Is also an accident, the third party's economic compensation, for more than the compulsory insurance compensation limit, by Insurance company Responsible for compensation, so the owners of friends as far as possible at the same time to cover compulsory insurance and three risks, so that in the event of a major traffic accident, the insurance company can help you pay the excess cost。 The three risks are also used to compensate for the loss of people and goods made by the other party。

U will be on the risk of car damage insurance

The first two kinds of insurance are used to pay the other party, and the car damage insurance is used to pay the insured person's own。 Including collisions, scratches, water-flooded fires, bruises, losses caused by natural disasters, etc。 Here also want to pay attention to two points: separate parts damage is not compensate, also don't try so hard in this case, naturally add work, separate into multiple parts damage, don't love dearly, the insurance company will help you repair; Modification, loss of vehicle interior and engine damage caused by flooding are not compensable。 So if you are very expensive to modify a buy a new equipment insurance, valuables had better not put in the car, compensate the engine has a special Water - related risk。

★ will be on the risk Non - compensable risk

Non - compensable means transferring 20 % of the original owner's liability to the insurance company。 Regardless of the exemption is divided into basic insurance and additional insurance, the former for the car damage insurance, the three basic insurance independent effective; The latter applies uniformly to the additional risks of motor vehicles。 Is when you miss driving crashed into a tree caused 1000 yuan of damage, because it is a unilateral accident, the insurance company normally compensate you only 80 % of the loss, that is, 800 yuan, but if you buy the non-compensable insurance, you can get 1000 yuan 100 % compensation。

★ don't have to on the self-combustion insurance

Self - combustion insurance is a kind of auto insurance to provide compensation for the situation of vehicle spontaneous combustion, this kind of auto insurance is limited to vehicle warranty payment, in fact, the warranty period of vehicle spontaneous combustion is responsible for by the manufacturer, so the new car is not recommended to buy。 If the warranty period has expired, you can purchase according to the actual situation。

★ don't have to go on water-related risks

Water - related insurance is mainly for engine damage caused by flooding compensation, if you are less flood area, so this kind of insurance is not necessary to buy。

U don't have to on the glass broken risk alone

Glass broken risk alone is not much need to buy, the insurance in fact as long as you learn to flexible processing, so you can turn into a car damage insurance。

★ don't go up Scratch risk

This can actually buy don't buy, look at the models, if the purchase model price is not expensive, paint cost is not very expensive, can not buy, the cost of their own maintenance is close to a risk again next year Buy insurance When the cost of rising, so it is not very cost - effective。

★ summary

If it is a daily use, the above four kinds of insurance is basically enough。 But in any case, it is important to observe traffic regulations and maintain a good driving habit。 Safe travel, happy is our pursuit of car life。

Four auto insurance strategies for beginners

In addition to the license plate, the next most important thing is to buy auto insurance。 For inexperienced novices, where should I buy auto insurance? Which car insurance is necessary? What kind of car insurance is suitable for what kind of car owners? These are the big questions。

Based on the general needs of the people, sir painstakingly compiled this " novice must see four auto insurance strategy", aimed at helping you clear your mind, rational choice of a car insurance in line with their own situation。

Automobile insurance Where to buy??

Now buy auto insurance mainly provides four ways:

First, when buying a car or in the future in 4 s shop

Second, app purchase

Third, go to the big insurance company business hall to buy

Fourth, buy it on the official website of the major insurance companies

Fifth, telephone purchase

Sir respectively on the four ways to buy the analysis and comparison:

Shop 4 s The price will be more expensive than the other way, because the 4 s shop has to earn a certain fee。 But according to sir, now 4 s shop in order to woo customers, there will be to buy auto insurance to send maintenance activities。 For send maintenance this matter, are benevolent wise men see wisdom, but sir calculate a bill: suppose 4 s shop launched to buy auto insurance to send a year of maintenance activities, a household car driving 10000 kilometers a year, need to do two maintenance, a maintenance cost is about 600 yuan, a year can save 1200 yuan, so it is also cost - effective。 ( for maintenance choose to do in 4 s shop owner, in fact is completely acceptable )

Mobile app Nowadays, many car-related apps can already realize the function of purchasing auto insurance ( for the users at the b - end and c - end ). this kind of app collects the auto insurance business of each major insurance company, and users can easily search for regions, compare prices, compare schemes and compare preferences, so as to select the most suitable auto insurance for themselves。

The other three ways I put him into one category - insurance company

Insurance company The price is cheaper than 4 s shop, but without after-sales service, the car insurance may not go to 4 s shop maintenance。

Sir's advice is whether the individual owner or choose 4 s shop more secure, maintenance and service can be guaranteed。 Maintenance store insurance agency business can choose mobile app, comprehensive information, transparent price。

What are the types of auto insurance?

Although there are many types of car insurance, sir summed up: one kind of car insurance is necessary to buy, another kind of car insurance is available or not to buy。

Compulsory insurance must be purchased , and the car damage insurance, third party insurance, excluding free compensation, Pirate rescue , company insurance, and so on。

1, what is compulsory insurance?

Compulsory traffic insurance is stipulated by the law of our country every car owners must be forced to buy insurance。 It effectively ensures that vehicles have the most basic insurance claims in case of traffic accidents。 Especially for some in addition to the car, the poor car owners in the home。 In the event of a traffic accident, compulsory insurance can replace his hard-to-pay financial compensation。 If not in accordance with the provisions of the purchase of compulsory insurance, the traffic administrative department of the public security organ shall have the right to detain the motor vehicle, and impose a fine of 2 times the premium payable。

2, why do you want to buy compulsory insurance?

A compulsory traffic insurance sign will be issued to the owner after the purchase of the compulsory traffic insurance, and the sign will also need to be affixed to the front windshield of the vehicle。 If not according to the requirements of paste, the traffic police can be deducted 1 points to the owner, a fine of 200 yuan。

How much does it cost to buy compulsory insurance?

Compulsory insurance premiums are based on the number of seats in the country to implement a unified price, six new car 9.50 yuan a year, six more than 1100 yuan。

If there is no accident insurance during the insurance period, the next year renewal according to the benchmark premium down 10 %, the minimum can be down 30 %。 However, if there are more accidents, the premium will rise in the coming year, up to 30 %, even by the insurance company refused to protect treatment。

4, pay strong insurance have what circumstance does not compensate?

Jiaoqiang does not compensate for all accidents, such as intentional accidents, drunk driving, and vehicle damage insurance during the theft of vehicles are not compensable。

5, what is the scope of compensation for compulsory insurance?

The amount of compensation for compulsory insurance is affected by whether there is a responsibility, whether to cause casualties。 For general vehicle injuries, the maximum compensation is $ 2,000 if the vehicle is liable and $ 100 if the vehicle is not liable。

If cause casualties, have the responsibility of medical expenses under the circumstances of the maximum compensation of 10 thousand yuan, the maximum compensation of 110 thousand yuan death。 No liability for medical expenses under the circumstances of the maximum compensation of 1000 yuan, 11000 yuan compensation for death。

6, what is the car damage insurance?

Car damage insurance refers to the insured or its permitted driver in driving an insurance vehicle insurance accident, resulting in damage to the insurance vehicle, the insurance company to compensate within a reasonable range。

How much does it cost to buy a car?

The premium cost of car damage insurance has a great relationship with the purchase price of the car and the number of seats。 There is a formula can be calculated, car damage insurance premium = basic premium + naked car price * rate。 While the average household 5 car damage insurance premium is 593 yuan, the rate is 1. 5%。

For example, a 5 - seater new car, car purchase price ( including travel tax ) is 128000 yuan, then its car damage costs are: 593 + 128000 * 1. 5 % = 2513 yuan。

Ps: except for compulsory insurance, the cost of other insurance is the original price。 But in the actual purchase process, there will be a certain discount, and different periods, different insurance companies discount rate is different。

8, car damage insurance under what circumstances don't compensate?

Car damage is only compensated for damage to the vehicle body, but some small parts of the individual damage is not covered by the compensation, such as rearview mirrors, lights, glass ( excluding skylight glass ), paint, wheels ( including tires and hubs ), etc。

For new cars that have not been licensed, or have not received a temporary license, the loss caused by the accident is not within the scope of compensation for the loss of the car。 In addition, if after the accident, can't find the accident insurance company can only compensate for 70 % of the loss。

Also need to pay attention to is, car damage insurance in compensation, will be based on the use of the vehicle after a certain depreciation compensation。 The depreciation rate for cars is 0. 5 % per month. 6%。

9 And, What is third party insurance?

Third party liability insurance Refers to the accident, in addition to the driver of the car and passengers caused by other people's personal injury or property damage directly, by the insurance company in accordance with the provisions of compensation。 For example, the insurance company is responsible for driving accidentally into an electric vehicle, damage to the electric vehicle, and compensation for the loss of life and death of the driver of the electric vehicle。

How much does it cost to buy third party insurance?

The cost of third party insurance depends on the level of coverage you choose。 Generally 5, 10, 15, 20, 30, 50, 1 million seven grades is the mainstream, of course, can also choose to insure more than 1 million, but the highest can not exceed 50 million。 Different levels of premium are charged differently。

Take the ordinary family car below 6 as an example, choose 50,000 grade, the premium is 710 yuan a year。 If you choose a level of 1 million yuan to 2234 yuan a year, now most people choose 500,000 or 100 two grades。

11, third party insurance under what circumstances do not compensate?

In the accident caused by the driver or passengers of the car casualties, driving killed, injured their own people, driving damaged their own vehicles, these are the three insurance does not compensate for the situation。

12, what is the scope of compensation for third party insurance?

Different responsibilities in the accident, the amount of compensation is also different。 Only when the other party full responsibility, can get full compensation。 If you are fully responsible, the insurance company can have 20 % of the exemption, the main responsibility is 15 % of the exemption, the same responsibility is 10 % of the exemption, secondary responsibility is 5 %。

13, what is the whole car stolen rescue?

Name is a good understanding, is for the whole car was stolen, robbery caused by vehicle losses to provide compensation services insurance services。 If the vehicle was stolen, robbed by the public security criminal investigation department at or above the county level for investigation confirmed full 60 - 90 days and no whereabouts, by the insurance company direct compensation。

14, buy stolen rescue how much money?

There is a formula for the insurance premium of the whole vehicle theft rescue: the insurance premium of the whole vehicle theft rescue = ( vehicle price - depreciation ) * premium rate + fixed premium。 Depreciation is 6 ‰, a month only for second-hand car or old car renewal effective, new car don't have to ignore。 Premium rate and fixed premium are different according to different models and uses, and ordinary household 5 car theft emergency basic premium is 120 yuan, the rate is 0. 49 %。

To make it easier to understand, give two examples。 Example 1: a 128000 yuan of ordinary home five new cars, the whole car stolen rescue premium = 128000 * 0. 49 % + 120 = 747. 2 yuan。 Example 2: a 128000 yuan ordinary home five car, has been in use for 2 years。 Then the renewal of the whole car stolen rescue premium = ( 128000 - 128000 * 6 ‰ * 24 months ) * 0. 49 % + 120 = 656. 9 yuan。

15, theft and rescue have what circumstance does not compensate?

If not the whole car was stolen, only the car parts such as tire wheel hub, lights, rearview mirror, etc。 In addition, if the vehicle is modified, unless there is a separate purchase of new equipment for the modified part of the risk, otherwise in the case of theft of the whole car according to the original car compensation。

16, the scope of compensation for illegal rescue

After the occurrence of theft accident, the need to provide motor vehicle registration certificate, motor vehicle driving license, purchase invoices, vehicle purchase tax payment certificate to prove the origin and legality of the vehicle。 Missing anything, increase 0. 5 % absolute free odds。 If the whole car is stolen, the original car keys lost an additional 5 % absolute free odds。

17, what is not exempt from compensation insurance?

The full name of the non-compensable risk is the special term of the non-compensable risk, which is a kind of additional risk。 In many accident compensation, insurance companies can have 5 % - 20 % car free odds。 You can avoid these odds and get full compensation when the owner buys a non-compensable car。

18. how much does it cost to buy a non - compensable insurance?

Excluding the cost of non-compensable insurance is quite cheap, its premium = ( car damage + three risks ) 20 %。 If a 128,000 yuan five-seater car, bought 500,000 three risks, then its non-compensable premium is: ( 1920 + 1721 ) * 20 % = 728 yuan。 This is the calculation method of the whole purchase, regardless of the exemption, in addition, regardless of the exemption can also be purchased separately for commercial insurance, seems everyone likes to buy separately now。

19, regardless of the non-compensable insurance under what circumstances do not compensate?

Purchase of non-compensable compensation is not under any circumstances, it also has four kinds of non-compensable cases: the accident did not leave a certificate to the traffic police can not be held accountable, car parked roadside scratches or third party escape, only to buy the basic risk of non-compensable insurance when the car was stolen robbed, frequent occurrence of additional deduction from the odds。

Sir want to say is that the daily more useful insurance is just a few, you just need to roughly understand what they can provide security, the corresponding cost is how much you can easily determine which should buy which shouldn't buy, don't silly to buy a full car insurance, may be really unnecessary。

What should novice auto insurance buy?

Sir found that in fact the most common car insurance scheme mainly has three kinds:

1. minimum plan: compulsory insurance + third party insurance ( 500,000 )

The cost of compulsory insurance is 950 yuan a year, a third party insurance ( 500000 ) is 1472 yuan, a total of 2422 yuan。 The scheme is the most economical, in addition to pay strong insurance, pay third party insurance, is very suitable for car price is not high or slightly less well-off car owners。 In fact, there is a minimum plan, is to buy only compulsory insurance, other all don't buy。 But few people will buy insurance like this, can be ignored for the time being。

2. basic plan: compulsory traffic insurance + third party insurance ( 500,000 ) + car damage insurance

The cost of compulsory insurance for one year is 950 yuan, the third party insurance ( 500000 ) is 1472 yuan, car damage insurance 2459 yuan, a total of 4881 yuan。 The plan increases the risk of car damage relative to the first, making it a good choice for new drivers who have just obtained a driver's license, as well as for wealthier car owners。

3. general plan: compulsory traffic insurance + third party insurance ( 1 million ) + vehicle damage insurance + non - compensation + vehicle theft and rescue

This scheme is generally 4 s shop to help the owner to buy the so-called full insurance, compulsory insurance cost is 950 yuan a year, a third party insurance ( 1 million ) is 1917 yuan, car damage insurance 2459 yuan, excluding free compensation ( three + car damage + robbery ) is 739. Four yuan, a total of 6065. 4 yuan。 This is mainly for new cars or slightly more expensive car owners, affordable car owners choose this insurance is also a good choice。

Ps: the above calculation method is calculated according to 150,000 new cars。

The above auto insurance purchase scheme is the most car owners will choose the scheme, sir suggested that you put these three schemes as a reference to the amount of auto insurance investment, combined with their own economic level to choose a combination of options。

What should we pay attention to when buying a car?

Beginners often can not buy auto insurance access, nature also easy to fall into the pit。 Sir summed up a few easy to recruit, hope to help you。

1, 4 s shop to buy auto insurance pit

Sir think 4 s shop is the pit of the sales staff fool, buy what risk, don't buy what risk, must choose according to their own economic level。 Before purchase, you can get to know the insurance cost of each major insurance company online, use the brochure to write down, and turn out the brochure before sales settled contrast, if the gap is too big to use other ways to buy insurance。

2. purchase Telephone auto insurance Want to compare three goods

Salesman telephone direct car insurance risk is relatively large, and has a certain amount of deception, must ask clear before buying, conditional recording, in addition, because I don't know the personal information of the specific salesman, chase responsibility is more difficult, serious may also encounter fraud。 After the order, according to the insurance policy number to the insurance company website query is true, we also want to determine the identity of the good send policy personnel, and then to the premium。

3, ask more, choose claims time is short

When buying auto insurance, but also consider the speed of claims, because some insurance companies claim longer, for now time precious office workers, really can't afford to wait。 Sir's advice is to have acquaintances ask acquaintances, no acquaintances on the internet for help net friend, some real insurance company is certainly won't tell you。

4, " three taboos": not full insurance, excess insurance and repeated insurance

Sir can understand those in order to save money, in order to get more compensation after the accident of the car owners, but sir had to popularize the legal knowledge to you:

Article 56 of the insurance law of our country stipulates: " the sum of the indemnity insurance premium of each insurer of duplicate insurance shall not exceed the insurance value。 Unless otherwise agreed in the contract, the insurer in accordance with its Insurance amount And the proportion of the sum of the insured amount shall bear the liability for compensation。 " the

In short, even if the applicant repeatedly insured, also won't get super value compensation。

China's " insurance law" article 39 also clearly stipulates: " the amount of insurance shall not exceed the value of insurance, more than the value of insurance, more than part of the invalid。 If the insurance amount is lower than the insurance value, unless otherwise agreed in the contract, the insurer shall bear the liability for compensation in accordance with the proportion of the insurance amount and the insurance value。 " the

Therefore, over - and under-insurance will not yield additional benefits。

Auto insurance is useless when there is no accident, but when you need it really feel the value of the goods。 After reading this strategy, sir hope everyone in the purchase of auto insurance when considering these:

1, choose the right for their own purchase channels

When buying auto insurance, not only consider the price is cheap, driving habits, vehicle types, buy auto insurance at different stages of the need to consider the problem, understand their own situation, and then choose suitable for their own purchase channels。

2, According to the specific circumstances of the combination of insurance

Sir mentioned in front of the three common combination of insurance, is just a reference, more combination is actually according to their own situation。 For example: driving skilled male car owners buy auto insurance will be partial economy, driving unfamiliar female car owners will be partial complete and security; Owners who don't have a garage will choose to buy stolen rescue。

3, The insurance amount should match the risk requirement

High coverage is unnecessary, too low can't get full risk protection, if you risk level is low, then buy a little more, otherwise you can buy a little less。

The following are questions from netizens:

Net friend a: how to buy auto insurance is the most cost - effective?

Expert a Principle 1: give priority to the purchase of full third party liability insurance。 The ability to compensate others for their losses should be the first priority in the purchase of car insurance, otherwise the accident will only be helpless。

Although the third party liability insurance and compulsory insurance function almost overlap, are used to compensate each other's medical or compensation costs after the owner's car crashed into a person。 However, from the current point of view, the compulsory insurance guarantee ability is limited, it is difficult to cope with major personal injury accident, generally should buy a third party liability insurance。

Principle 2: the insured amount of the three risks shall be subject to the compensation standard of the locality。 The standards of compensation in various parts of the country is different, according to the highest standard of automobile insurance compensation calculation, if one person died, Shenzhen area maximum compensation can reach 1.5 million yuan, Hubei area maximum may also be more than 600 thousand yuan。 It is recommended that the owner look at his old insurance policy, if the amount of insurance is insufficient, it is recommended that at least 200,000 above, conditional insurance of 500,000。

Principle 3: buy the car personnel insurance, then buy the car damage insurance。 If there is no other accident insurance and Medical insurance The owner, to buy their own 100 thousand driver insurance as a medical cost, responsible for the family; If the passenger is more likely to ride, can cover passenger insurance, 50 - 100 thousand / seat, responsible for the family and passengers。 If the chance of riding is low, it is more economical to insure 10,000 seats per seat。

Principle 4: buy car damage insurance and then buy other insurance, traffic accidents are often accompanied by car damage, repair costs should not be underestimated, the protection of car love is also very important。

the vehicle damage insurance Is the most widely used in vehicle insurance insurance, whether it is a daily casual small scratches, or suffered accidents caused serious damage to the car, as long as it is within the scope of insurance liability, can apply to the insurance company for compensation for repair costs。 However, the vehicle loss insurance also has a variety of exemption clauses, so the owner should carefully study the terms of the vehicle loss insurance before insurance, grasp the content of the vehicle loss insurance, so as not to fall into the error of claims。

Principle 5: buy three risks, driver passenger seat liability insurance, car damage insurance of non - indemnity。 For a little more money, let the insurance company compensation without discount。

The so-called non-compensable insurance, its full name is " non - compensable special liability insurance"。 Excluding special liability insurance is divided into two kinds of basic insurance without exemption and additional insurance without exemption。 The main risks corresponding to the basic insurance excluding the non-compensation are the vehicle loss insurance and the third party liability insurance。 Additional risks excluding the corresponding is such as " scratch risk", " illegal rescue" and other additional insurance。

Principle 6: other types of insurance shall be purchased selectively in combination with their own needs。 Such as illegal rescue, glass broken risk insurance, such as relative to the first five risks, the impact on family happiness and property is not as serious as the first five risks, should be in front of the five principles to meet the case to consider the insurance in principle 6。

Net friend b: how to buy auto insurance does not spend money, novice must see

Expert b: the level of premium is closely related to the number of occurrences and amount of claims made in the previous year。 According to the regulation, as long as the owner within one year without any violation records, insurance and claims, the owner in the second year to pay the premium will be commercial insurance, compulsory insurance premium cut, at the same time will also be listed by the insurance company as a high quality customers enjoy preferential auto insurance。 The second year of auto insurance should be in the way of purchase, insurance choice to make a reasonable choice, not only to achieve full insurance, but also can't waste money。 Choose the most suitable insurance portfolio, in order to make the future driving life is the real interests of the owners, I hope the above content is helpful to you。

Comments

Post a Comment